Homestead Exemption filing open until April 1

Published 7:43 am Wednesday, January 19, 2022

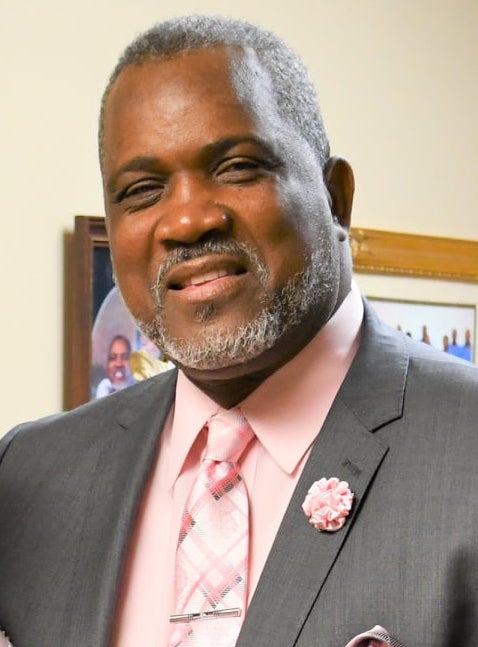

Keeping more hard-earned money helps homeowners across the county, and the Homestead Exemption can help do just that. Panola County Tax Assessor and Collector O’Del Draper said the exemption is “a privilege offered to eligible taxpayers by the State of Mississippi.”

April 1, 2022, is the last day for signing Homestead Exemption. If you have signed in the past and have no changes you will not have to sign a new form.

Draper noted the deduction isn’t automatic and there are different types to apply for.

Tax Assessor office employees say a person could use the term credit or discount to make Homestead Exemption more clear. The credit or discount is not granted automatically. An application must be filed and each taxpayer must qualify for the credit. There are two types of homesteads classifications – regular and additional typically called ‘special.’”

Regular credit (discount) is given to all eligible taxpayers if it is the primary residence.

The additional special discount goes a bit further with savings.

The credit is from all ad valorem taxes assessed to property, limited to the first $7,500 of assessed value. The difference from the regular versus the special is “no” dollar limit is placed on the actual discounted tax dollars. Any ad valorem taxes imposed on the assessed value of property over the first $7,500 however must be paid.

With COVID-19 restrictions, Draper and his office have instituted a homestead phone number, (662) 563-6270 to help taxpayers set up appointments.

The Homestead application process opened on Jan. 3 and will remain open until April 1. This time period is set by State statute and is the same for all 82 counties. To apply for first time, you must visit the Tax Assessor office at either the Batesville or Sardis Courthouses and bring following documents:

* A copy of your recorded warranty deed.

* Mississippi car and/or truck tag numbers.

* Social Security cards for you and your spouse, if married.

Homestead is only for full-time residents of Panola County. To qualify you must have a Mississippi driver’s license and car tags, pay state income tax, and be a registered voter of Panola County.

If you are applying for the “special” homestead credit for those more than 65 years old by January 1 of filing year, bring proof of your birthdate to qualify for the additional tax credit.

To apply for a Social Security disability benefit “special” homestead, bring a current letter regarding your disability status from the Social Security office.

You don’t have to reapply each year except for the following reasons:

* If you have been declared 100 percent Disabled Veteran, you must bring proof and update your Homestead. If you are an unmarried widow of a 100 Disabled Veteran, you must bring proof and update your application.

* If you or your spouse became 65 years of age in 2021 (bring proof).

* If you built a new home, bought a different home, or bought a mobile home (must be on your own land).

* If your or your spouse became disabled (bring proof).

* If you bought or sold land that may possibly be added or deducted from Homestead.

* You got married, divorced, or either spouse deceased.

* You will need your car tag numbers.

It is the responsibility of the applicant to update pertinent information regarding their homestead in order for the homeowner to be eligible and remain eligible for the homestead credit or discount.

Draper said his office accepts the applications but the decisions to grant and disqualify them are made by the Mississippi Department of Revenue. Some reasons you can be disqualified for homestead include:

* Owing Mississippi income tax.

* Claiming to be a resident of another state when assessed with income tax.

* Having homestead on any other property in the county or in any other state. You must be living full-time on the property receiving the exemption.

Keep in mind if your homestead is disqualified by the State, you will be charged the amount of credit or discount you may have received in a prior year the following year. This is called a chargeback and will be reflected on your tax statement.

The penalties that can be imposed for a fraudulent Homestead Exemption includes the additional assessment of double the amount of taxes lost due to a fraudulent claim, a misdemeanor charge, and a charge of perjury, which is a felony, a fine of up to $5,000, and imprisonment of up to two years or a combination thereof.