County: ‘no tax increase’

Published 11:06 am Tuesday, September 19, 2017

County: ‘no tax increase’

By Rupert Howell

Panola County supervisors expect no noticeable changes to the county’s portion of property taxes for the coming year following last week’s approval of the 2017-2018 fiscal year budget that needs to raise $13,746,426 in ad valorem taxes for the $37,319,115 total revenue needed.

Board members approved that budget Thursday following an earlier public hearing where no citizens attended to express opinions or protest budget figures proposed by the supervisor board.

The 800-pound elephant in the room is the knowledge that next year’s levy will not include Panola Medical Center that will be tax exempt and also only a portion of Batesville Casket Company which has “gutted” of most equipment will be on county tax rolls.

Both school districts in the county will not realize an increase or maybe a small decrease. The Town of Sardis’ millage should remain the same while the City of Batesville’s millage will experience an increase that will show up on statements for property owners there, all collected by the county.

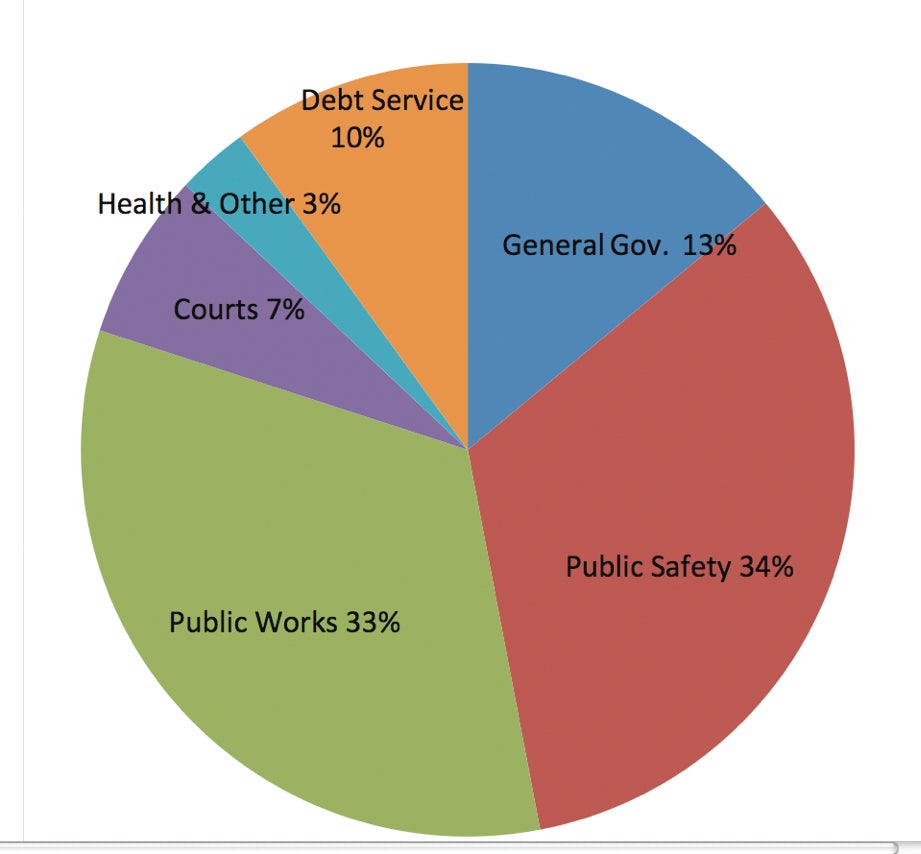

General government expenses which includes the courthouse offices require $3,165,764, 13%, while courts take up $1,639,271, 7%. Public safety includes the Sheriff’s Department and Panola County Jail with $8,073,188 or 34% budgeted. Public Works, which includes the Road Department, is budgeted for $7,935,450, 33%.

The figures do not include public schools which in North Panola is an additional 47 percent and in South Panola an even 50 percent of ad valorem tax dollars.

The county’s ending cash balance is projected to be $12,400,604 compared to a beginning cash balance of $15,632,810, a 20 percent decrease in that fund’s balance.